Let's talk about something that can change your financial game: Ripley credit card. If you're looking for a way to boost your purchasing power while earning rewards, this might just be the answer you've been searching for. Whether you're a shopaholic or someone who wants to build credit responsibly, Ripley has got your back. So buckle up, because we're diving deep into the world of credit cards and uncovering everything you need to know!

Now, before we get into the nitty-gritty, let's set the stage. Credit cards can be a double-edged sword. On one hand, they offer flexibility, rewards, and convenience. But on the other hand, if you're not careful, they can lead to debt spirals faster than you can say "balance transfer." That's why understanding your options is crucial—and Ripley credit cards are here to make things easier.

In this guide, we're going to break down everything from the benefits and features of Ripley credit cards to tips on how to use them wisely. By the end of this, you'll feel like a credit card pro ready to take on the world—or at least the shopping mall. So, are you ready to dive in? Let's go!

Read also:Glassman Kia Southfield Your Ultimate Car Buying And Servicing Destination

Table of Contents

- What is Ripley Credit Card?

- Types of Ripley Credit Cards

- Benefits of Using Ripley Credit Card

- Eligibility Requirements

- Application Process

- Fees and Charges

- Rewards and Perks

- Tips for Responsible Credit Card Use

- Frequently Asked Questions

- Conclusion: Is Ripley Credit Card Right for You?

What is Ripley Credit Card?

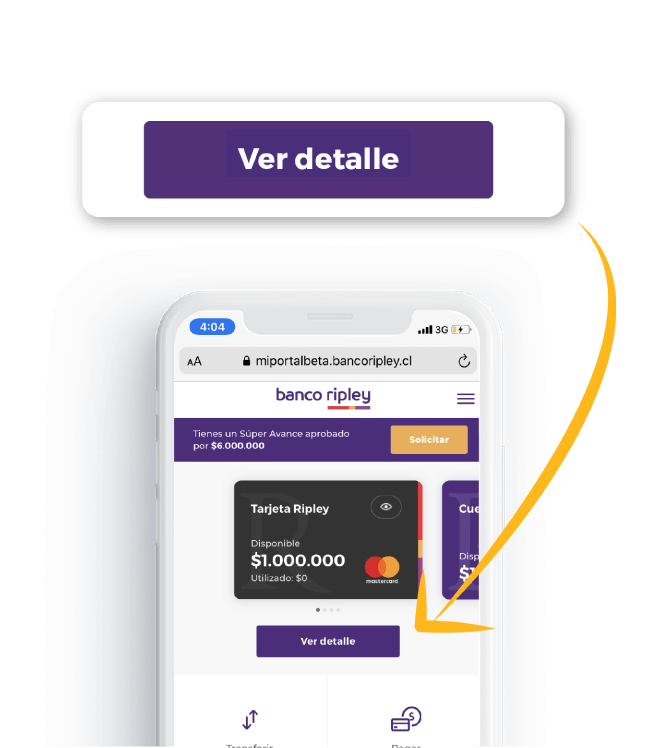

Let's start with the basics. Ripley credit card is more than just a piece of plastic; it's a financial tool designed to give you access to credit when you need it most. Whether you're shopping for clothes, electronics, or planning a vacation, Ripley offers a range of cards tailored to different lifestyles and budgets.

But here's the kicker: Ripley isn't just about letting you buy stuff now and pay later. They also offer rewards programs, cashback, and exclusive discounts that can save you serious dough in the long run. So, it's not just about spending—it's about spending smart.

Why Choose Ripley?

Here's the deal: Ripley stands out because of its customer-centric approach. They don't just throw a card at you and hope for the best. Instead, they provide resources, tools, and support to help you manage your finances effectively. From budgeting tips to personalized offers, Ripley is all about empowering you to take control of your financial future.

Types of Ripley Credit Cards

Not all credit cards are created equal, and Ripley knows that. That's why they offer a variety of cards to suit different needs. Let's break them down:

Ripley Visa Card

This is your go-to card if you're looking for global acceptance and a solid rewards program. With the Ripley Visa card, you can earn points every time you make a purchase, which can be redeemed for travel, merchandise, or even cashback.

Ripley MasterCard

Prefer MasterCard? No problem. The Ripley MasterCard offers similar benefits but with a focus on security features like chip-and-PIN technology. It's perfect if you're someone who values safety and convenience.

Read also:Discover The Charm Of West Bay Street Bahamas Your Ultimate Guide

Ripley Rewards Card

For those who love earning rewards, the Ripley Rewards card is your best bet. This card offers accelerated points on specific categories like dining and entertainment, making it ideal for lifestyle enthusiasts.

Benefits of Using Ripley Credit Card

So, why should you consider getting a Ripley credit card? Here are some of the top benefits:

- Exclusive Discounts: Ripley partners with numerous brands to offer you special deals and discounts.

- Rewards Programs: Earn points or cashback on every purchase, which can add up quickly.

- Flexible Payment Options: Choose from various payment plans to suit your budget.

- Travel Benefits: Many Ripley cards come with travel perks like free airport lounge access and travel insurance.

- Customer Support: Ripley provides 24/7 customer service to assist you with any issues.

Eligibility Requirements

Before you apply for a Ripley credit card, it's important to know if you qualify. Here's what you'll need:

Age

You must be at least 18 years old to apply for most Ripley cards. Some premium cards may have higher age requirements.

Credit Score

Your credit score plays a big role in determining your eligibility. Ripley typically looks for applicants with good to excellent credit scores, but they do offer options for those with lower scores as well.

Income

Having a stable income is crucial. Ripley will want to see proof of your ability to repay any credit extended to you.

Application Process

Applying for a Ripley credit card is easier than you think. Here's a step-by-step guide:

Step 1: Gather Your Documents

You'll need to provide identification, proof of income, and possibly a recent utility bill to verify your address.

Step 2: Choose the Right Card

Not all cards are suitable for everyone. Take some time to research and find the card that aligns with your financial goals.

Step 3: Submit Your Application

You can apply online, over the phone, or in person at a Ripley branch. The process is straightforward and usually takes just a few minutes.

Fees and Charges

No one likes surprises, especially when it comes to money. Here's a breakdown of the fees you might encounter with Ripley credit cards:

- Annual Fee: Some cards come with an annual fee, but many offer a waiver if you meet certain spending thresholds.

- Interest Rates: Ripley offers competitive interest rates, but these can vary depending on the card and your creditworthiness.

- Foreign Transaction Fees: If you plan to use your card abroad, be aware of potential foreign transaction fees.

Rewards and Perks

One of the coolest things about Ripley credit cards is the rewards program. Here's what you can expect:

Earn Points

Every time you make a purchase, you earn points that can be redeemed for various rewards. The more you spend, the more points you accumulate.

Cashback Options

Some cards offer cashback instead of points, which can be a great option if you prefer cold, hard cash.

Exclusive Events

As a Ripley cardholder, you may receive invites to exclusive events and promotions that are not available to the general public.

Tips for Responsible Credit Card Use

Using a credit card responsibly is key to avoiding debt and building a strong credit history. Here are some tips:

- Pay on Time: Always make your payments by the due date to avoid late fees and interest charges.

- Stay Within Your Limit: Try not to max out your card. Keeping your balance low improves your credit utilization ratio.

- Track Your Spending: Keep an eye on your expenses to ensure you don't overspend.

- Use Rewards Wisely: Don't let rewards lure you into unnecessary purchases. Stick to your budget.

Frequently Asked Questions

Here are some common questions people have about Ripley credit cards:

Can I Get a Ripley Card if I Have Bad Credit?

While Ripley prefers applicants with good credit, they do offer options for those with lower scores. It's worth applying to see what's available.

What Happens if I Miss a Payment?

If you miss a payment, you may incur late fees and see an increase in your interest rate. However, Ripley offers resources to help you get back on track.

How Long Does It Take to Get Approved?

Approval times vary, but many applicants receive a decision within a few days. Some may even get an instant approval online.

Conclusion: Is Ripley Credit Card Right for You?

Wrapping things up, Ripley credit cards offer a fantastic blend of flexibility, rewards, and customer support. Whether you're a seasoned credit card user or a newbie, there's likely a Ripley card that fits your needs.

But here's the thing: credit cards are powerful tools, and with great power comes great responsibility. Use them wisely, and they can help you achieve your financial goals. Misuse them, and they can lead to trouble.

So, what are you waiting for? Head over to Ripley's website, check out their card options, and take the first step towards financial freedom. And don't forget to share this guide with your friends—knowledge is power, and power is priceless!